ACCIDENT PROTECTION PLAN FAQs:

Can past accidents be covered on the Accident Protection Plan? Such as services that were rendered from an accident that occurred prior to the plan being effective allowable to receive benefit?

Although there are no pre-existing exclusions on the policy, the date of accident has to occur while the member is covered on the plan. Accidents that had occurred prior to being covered on the accident plan would not be allowed, as well as services rendered for the accident in the past and present. Also, accidents claims must be sent in for the same year the accident occurred. For example, if you enrolled in the Accident Protection Plan in 2015 and 2016, as the New Year begins you cannot submit a claim from an accident that occurred in 2015.

MEDICAL/PRESCRIPTION PLAN FAQs:

Where can I find an in-network provider in my healthcare network?

Finding an Alliance provider:

- Visit www.umr.com

- Click ‘Find a Provider’

- Select ‘Alliance (The) –Employee Health Care Alliance Cooperative’

- Click ‘Find a Doctor’

- Filter results by searching for a provider in your area by name, specialty, facility or quality score’

Finding a Private Healthcare Systems provider (if you are outside Alliance’s primary service area):

- Visit www.umr.com

- Click ‘Find a Provider’

- Select ‘Private Healthcare Systems (PHCS)-Multi Plan’

- Click ‘Select PHCS Healthy Directions’, then click ‘go’

- Filter results by searching for a provider in your area by name, specialty, or facility

Finding a United Healthcare –Choice Plus provider:

- Visit www.umr.com

- Click ‘Find a Provider’

- Select ‘United Healthcare –Choice Plus Network’

- Click ‘Search for a Medical Provider’

- Filter results by searching for a provider in your area by name, specialty, facility or quality score

WEX FAQs:

What is the WEX debit card? How does it work?

The WEX debit card can be used instead of cash to pay for eligible services and out-of-pocket expenses that qualify. You will receive the WEX card automatically if you elect Mecical coverage in order to utilize your Health Reimbursement Account funds or if you sign up for the Health Flexible Spending Account. If you elect Medical coverage and receive an HRA or if you elect a FSA, your total annual contribution for the accounts will be loaded on the card and is available to use right away. You may be asked to document your WEX debit card purchases by providing itemized receipts (keep your receipts anytime you use the card). Do not submit your receipts until requested to do so. WEX will send you a list of transactions that were not substantiated at the point of sale, at which point you will return to WEX a copy of your receipts. You will be asked to repay the expense if you make a purchase with the card and cannot provide an itemized receipt for the expense.

Why am I required to submit a receipt to WEX even though I used the WEX debit card?

All services that are paid for using HRA/FSA dollars require specific information in order for the service to eligible such as: date of service, description/type of service, provider/merchant, patient name (or dependent name), and dollar amount. When using the WEX debit card not all that information is reported to WEX. Larger businesses, hospitals, dental office, pharmacies, etc… have the technology in their card reading systems to pull all the info that is needed when using the WEX debit card to forward to WEX. However, these systems are very expensive and not all merchants will have this available so when you use your card at smaller doctor offices, pharmacies, etc…not all the necessary information will pull from the card reader and WEX will need to ask you for that information. Regardless of what option you utilize for HRA/FSA spending reimbursement –whether debit card or paper claim form –it is important to always hang on to your receipts from your purchases or services.

Can I use my FSA and/or HRA dollars for DOT physicals?

Yes, the DOT exam is performed by a medical professional and it’s an actual physical so it is considered an eligible expense.

GENERAL FAQs:

Where can I find our Insurance carrier information?

There are a few places to find this info:

-http://grandehealth.com/health-benefits/

-On your insurance card you will find the customer service number, group number, your member ID/subscriber number, and website address

-Benefit Brief and New Hire Associate Booklet (last page)

-UltiPro>Links section

-SharePoint> Human Resources>Benefits.

I lost/misplaced my insurance card, how do I go about getting a new one?

Contact your insurance’s customer service to request a new card by providing the company’s group number:

- UMR –800-826-9781 (Group # 76411544)

- Care Plus Dental –800-318-7007 (Group # PPD-021)

- Delta Dental –800-236-3712 (Group # 90214)

- NVA–800-672-7723(Group #: Option 1–8955 0001 01; Option 2 –8955 0002 01)

You also have the option to request a new card by logging on to your account through UMR, Delta Dental or Superior Vision. You must have an active account set-up to order new ID cards. If you do not have an account set up, you can do so by visiting the website for these benefit plans and create a new account. You will need to know your current member ID number. If you do not know that you will need to request a new card by calling the customer service representatives.

How do I update/add a contact in UltiPro?

Log into UltiPro and go to the Contacts page (Myself>Contacts)

- To update a contact:

- Click on the contacts name and then click the ‘Edit’ button

- Update the necessary info (name, SSN, Relationship, etc.)

- Click ‘Save’ to save the changes

- To add a new contact:

- Click the ‘Add’ button at the top of the screen

- Enter in the necessary info: First and last name, relationship and designation, date of birth and social security number

- Required info will be marked with a red dot

- Record any other necessary info, such as address, phone number, email, etc.

- Click ‘Save’ to save new contact

What is considered a life event?

A qualified life event is an event that allows you to make changes to your benefits mid-year, without having to wait until open enrollment. The only time Associates can make changes to their benefit elections during the middle of the plan year, is if they experience a qualifying life event. Life events include:

- New hire benefit eligibility

- Getting married

- Having a baby or a new dependent (example: adoption)

- Loss of spouse through divorce or death

- Loss of coverage from another plan

- Change in eligibility of a dependent (example: overage status, dependent eligible for own insurance)

Associates have 30 days from the date of their life event to complete their benefit changes in UltiPro. The Life Events are defined as follows in UltiPro:

- I am a new Associate

- I have a change in my marital status

- I have a new dependent

- I want to remove a dependent

- I want to update/add beneficiaries

I have a change in my marital status

This life event is for any Associate who has had a legal change in marital status. It includes marriage, divorce, legal separation, annulment, or any other change in marital status. You may also update your beneficiary information as necessary. Remember to include your spouse’s date of birth and social security number if adding them.

I have a new dependent

This life event is for an Associate adding a new dependent. It includes the birth of a child, adoption, a legal directive, or a spouse who lost his/her coverage. If your marital status has changed and you want to add your new spouse, select the”I have a change in my marital status” life event.

I want to remove a dependent

This life event allows you to remove a dependent. It includes removing a dependent who has reached the maximum age to be covered, who has his/her own coverage, or is no longer your dependent.

I want to update/add beneficiaries

You are able to add/update your beneficiaries for the life insurance policies at any time. This life event will allow you to do so for each life insurance policy you are enrolled in. Remember to include the date of birth and social security number for beneficiaries.

How do I complete a life event?

Log into UltiPro, hover over the ‘Myself’ tab and click on the link for ‘Life Events’, select the corresponding ‘Life Event’ to make your benefit updates. Enter in the date of the event (Events cannot be future dated; you must make the changes on or after the event has occurred. Coverage will always date back to the effective date.) Verify your dependents and/or beneficiaries. Should you need to add a new dependent do so at this time by clicking the ‘add’ button and entering all the necessary information. For a newborn, if you do not have the Social Security Number, please enter in 999-99-999 for the time-being, and update once received. Then, go through and make your benefit elections and changes. You will have to re-enroll in your coverage’s as the system will not populate what you currently are enrolled in.

- You can view your current elections in the upper right hand corner by clicking the small black arrow next to the plan name.

- You may not change plans mid-year. For examples if you elected dental plan 1 you cannot change to dental plan 2 mid-year. Those changes can only be made during open enrollment.

As you reach the summary page, review and make sure all elections are correct. Then click submit, to submit your benefit changes for approval. Should there be any questions on your benefit changes you will be contact by the Benefit Analyst via phone or email.

Why can’t I remove my dependent from my contacts list?

Once contacts are entered into UltiPro, they cannot be removed. Should you need to remove a dependent from your insurance plans due to loss of eligibility (divorce, overage status, or death) you will have to complete the Life Event –‘I want to remove a dependent’ Once in the Life Event program you will go through each benefit plan to re-enroll. To remove the dependent from the plan, simply do not check the box next to their name. Note: Be sure to elect the correct benefit option should removing the dependent move you into a different benefit option (i.e. going from Family to Associate +1 or Associate +1 to Associate). As you reach the summary page, review and make sure all elections are correct. Then click submit, to submit your benefit changes for approval. Should there be any questions on your benefit changes you will be contacted by the Benefit Analyst via phone or email.

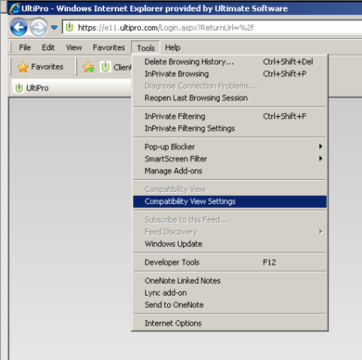

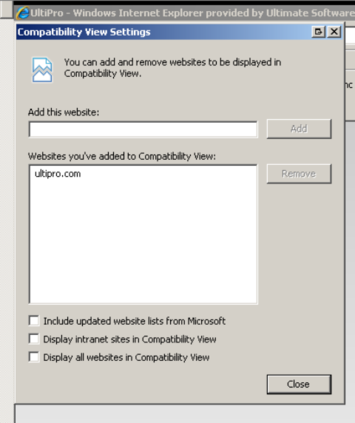

What compatibility view should I be using when going through open enrollment process?

If you are completing your 2016 Open Enrollment at home or on a personal computer you will want to make sure you are using the correct internet browser as the UltiPro program is not compatible with all internet browsers. Below is a list of common browsers that are compatible with UltiPro: Internet Explorer 8 (only in compatibility view), 9, 10, & 11

Firefox 35, 36

Google Chrome 41

Why aren’t Long Term Disability and Short Term Disability showing on my summary page when I completed my enrollment?

Long Term Disability and Short Term Disability are a Grande sponsored benefit that you do not have to enroll in during Open Enrollment; it is a benefit that is automatically available to you.